An “army” of European Union (EU) and International Monetary Fund (IMF) officials arrived in Dublin on November 18 “seeking to foist a large loan on Ireland in a bid to prop up the country’s embattled banking sector and save the European currency”, the Morning Star said that day.

Irish finance minister Brian Lenihan told MPs that Ireland, the EU and the IMF were exploring the prospect of forming “a contingency capital fund that would stand behind the banks”, the article said.

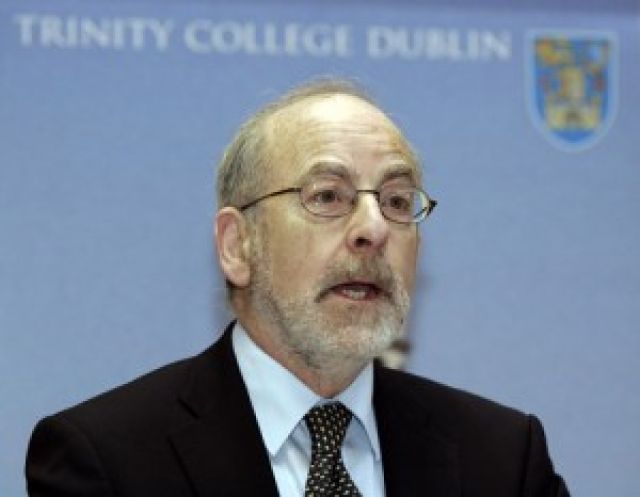

Irish Central Bank governor Patrick Honohan forecast that Ireland would negotiate a loan facility with the EU and IMF worth “tens of billions”, the Morning Star said.

The Morning Star said Ireland’s banks had already received €45 billion of government funds as part of a bailout package in response to the “global financial crisis”. This has pushed Ireland’s deficit to an unprecedented 32% of GDP.

Mark Weisbrot, co-director of the Centre for Economic Policy research, said in the November 17 >em>Guardian that “another one of the so-called ‘PIIGS’ countries [Portugal, Ireland, Italy, Greece and Spain] is being led to the slaughterhouse”.

Weisbrot said the austerity measures demanded by the EU and IMF in return for a loan would further deflate Ireland’s economy, which has been in recession for the past three years.

Income per person had already declined by more than 20% since 2007, Weisbrot said, and unemployment had tripled.

Weisbrot said European officials “want to squeeze Ireland, they want more fiscal tightening and they want to shrink the size of the government. And they want it now, even if it means that Ireland will sink further into recession.”

The Morning Star said Mary Lou McDonald, vice-president of Irish republican party Sinn Fein, called on the government to “grow a backbone, stand up for the national interest and tell the EU and the IMF to get lost”.

McDonald said that any loan “will have to be repaid and it’s ordinary taxpayers who will end up paying for this”.

McDonald said the history of IMF “bailouts” in other countries was “mass privatisation of vital public services and huge unemployment”.

The IMF and EU push to bail out Ireland’s financial system comes amid savage spending cuts being imposed by the Irish government as part of an austerity drive to cover the costs of bailing out the private banking system.

Sinn Fein is the only party represented in the Dail (Ireland’s parliament) to oppose what it calls the “consensus for cuts”.

Sinn Fein social protection spokesperson Aengus O Snodaigh said republicans would not be part of a consensus for “savage cuts, further deflation and unemployment”, An Phoblacht said on October 18.

Sinn Fein has released its own plan for an alternative response. It would seek to stimulate the economy and gradually reduce the deficit via significant public investment to create hundreds of thousands of jobs.

The plan would be funded by shifting the tax burden onto the rich, cutting the pay and perks of top public servants and politicians, and imposing a 1% wealth tax on all assets worth more than €1 million euros.

The Irish Council of Trade Unions has called for a national demonstration against the austerity measures on November 27, the Morning Star said. Sinn Fein has also called for a demonstration against the cuts for December 4.