The Reserve Bank claims to be impartial, but the big banks are big winners from the rise in interest rates. Peter Boyle explains.

The Reserve Bank claims to be impartial, but the big banks are big winners from the rise in interest rates. Peter Boyle explains.

Ten million workers are struggling but Australia’s national net wealth, if redistributed, could end the crushing poverty which directly accounts for at least 10% of the suicide toll. Gerry Georgatos reports.

Workers need a fairer, democratically accountable, transparent and responsive alternative to the Reserve Bank of Australia, argues Graham Matthews.

Treating housing as a commodity has made it inaccessible to people who need homes. But it doesn’t have to be like this, argues Peter Boyle.

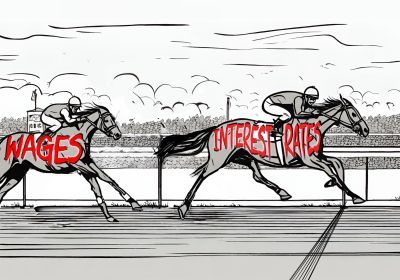

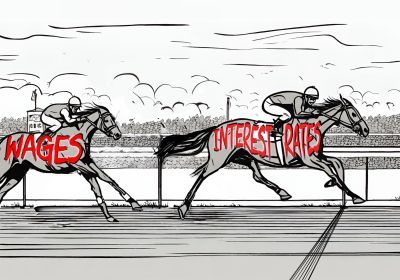

Reserve Bank governor Philip Lowe apologised to those who took out home loans on the basis of his promise not to raise interest rates. But he had no apology for wage earners trying to make ends meet amid sharply rising prices. Peter Boyle reports.

Capitalism is in crisis and new Labor Treasurer Jim Chalmers has offered little by way of analysis and even less optimism, argues William Briggs.

In February the Reserve Bank of Australia (RBA) reduced the cash rate to 2.25%, a rate it then maintained at its March meeting. While there has been a great deal of commentary on this in the mainstream press, especially in the Australian Financial Review, the left press (for lack of a better term) has been stunningly silent.