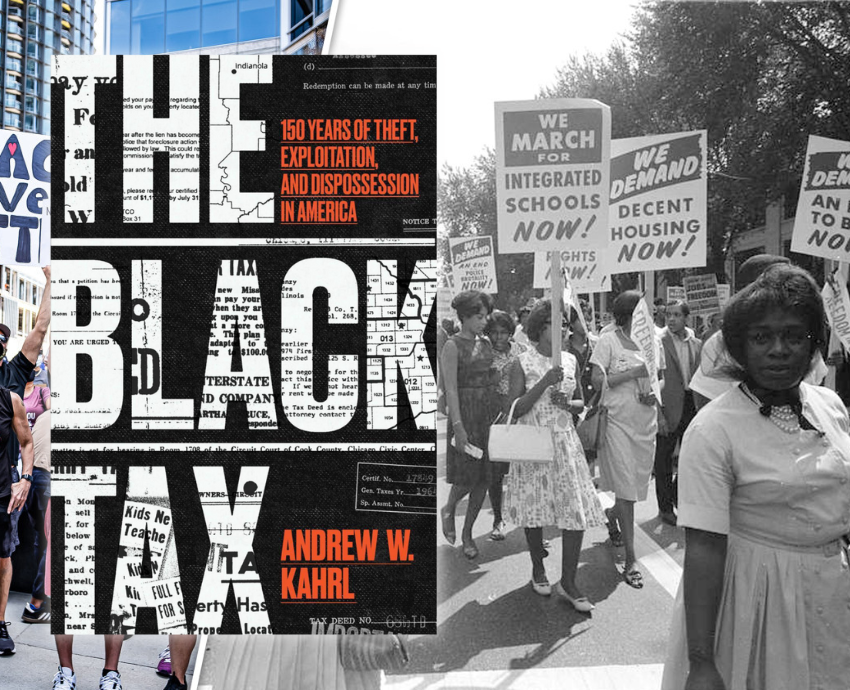

The Black Tax: 150 Years of Theft, Exploitation, and Dispossession in America

By Andrew W Kahrl

University of Chicago Press, 2024

456pp, RRP $36.99

Andrew W Kahrl, professor of History and African American Studies at the University of Virginia, has authored a valuable book that is important for understanding the relationship between national oppression and white supremacy. That relationship is a key to how the billionaire class dominates the working class in the United States.

The author asks: “Why has racial equality remained such an enduring problem in America, and what forces fuel its persistence?”

The book opens with three stories of Black working-class homeowners in Long Island, New York and how they were treated by the real estate, banking and tax systems of entrenched racial discrimination.

In one case, a Black woman bought a $50,000 modest two-bedroom home in Roosevelt, New York, in the late 1970s with a $200-a-month property tax encumbrance. In the United States, property taxes are imposed by local jurisdictions. The property tax was set at the same level as that of a wealthier white homeowner in a neighbourhood who bought a $200,000 home.

In a second example, a Black working mother in 1984 paid $35,000 for a Long Island home. She paid a higher property tax than homeowners in predominantly white communities.

In a third example, a working-class Black woman bought a $10,000 home in Hempstead, Long Island. When she went to sell the home, she discovered she no longer owned it. An unpaid tax debt attached to the property (a lien) meant the home had been sold from under her in a tax lien auction. Tax liens by banks or private contractors are a common trick to take away property from working-class people.

Behind legal property theft

While legal segregation in the South — which took shape after the defeat of Reconstruction in the late 19th century — only ended with the victory of the civil rights movement in the 1960s. The less open de facto segregation (for example, in real estate) across the north and west was just as damaging for Black people.

The author shows how tax laws, housing and real estate were used to deny wealth to African Americans and ghettoise Black people. There were large areas in major cities and suburbs where African Americans could not buy homes, or if they did, they faced white neighbours’ backlash.

Kahrl points to “the legacy of housing policies and real estate industry practices that powered the growth of the white middle class and white household wealth-building in mid-20th century America while simultaneously constraining Black mobility, deepening racial segregation and subjecting Black Americans to numerous and devastating forms of economic predation and plunder”.

Integral racial and national oppression of Blacks has been central to building the white supremacist capitalist state in the US.

The ruling-class reasoning is simple: keep white people onside by convincing them they are better than Black people. Why else wouldn’t poor white working-class people see Black workers as natural allies?

Dynamics of racial oppression

The book includes five parts: Part I: Jim Crow’s Fiscal Order; Part II: Black in the Metropolis; Part III: A Local Struggle; Part IV: Age of Results; and Part V: Neoliberalism at Home.

In his conclusion, Kahrl writes about a 2022 situation in the majority Black city of Jackson, Mississippi — where the water system shut down due to a lack of resources — and the school system in Philadelphia, Pennsylvania: “In both cases, the majority-Black city and school district lacked the resources needed to make the necessary repairs and upgrades on their own.

“Over the previous four decades, Jackson’s local tax base had shrunk 20 percent, as first whites and then middle-class Blacks fled to surrounding suburbs.

“During that time, a succession of Republican governors and state legislatures slashed taxes on the state’s businesses and highest owners, raised taxes on the state’s poor, and starved the state capital and its 82 percent Black population of revenue.”

Even after the end of Jim Crow and other forms of legal segregation in real estate and banking, the Black population — except for a minority of upper income-earners — is as poor, or worse off than ever.

Class exploitation, which is not new, is worse for all working people but doubly so for African Americans. As throughout US history, they are forced to pay higher taxes for less and are the last hired and first fired in most jobs.

Counter-revolution and fightback

Worse, the rollback of the civil rights gains after the 1960s has been fiercely attacked and undermined ever since the John Roberts-run Supreme Court took power in 2005. President Donald Trump and Roberts are joined together in accelerating the imposition of an authoritarian and racist state.

Black freedom fighters have fought on their own for much of US history. Black Marxists, however, have joined independent Black organisations and multinational revolutionary groups, knowing that to win a socialist revolution requires a unified revolutionary socialist movement of all ethnic groups.

Reforming the capitalist system, as the last half century has shown, cannot end racial oppression. Only a mass upsurge against the capitalist class, led by Black and white working-class unity, can bring radical change. Unless the “race issue” is understood, and how a minority population leadership is key to a successful revolution, the freedom struggle will not succeed.

The Black Tax illustrates the connection between Black national oppression and the construction of a powerful capitalist state, where Blacks have been treated as second-class citizens.

Kahrl’s book should help all readers better understand the combined race and class dynamics of political and social struggles.