Video: The Panama Papers: Victims of Offshore. YouTube/ICIJ.

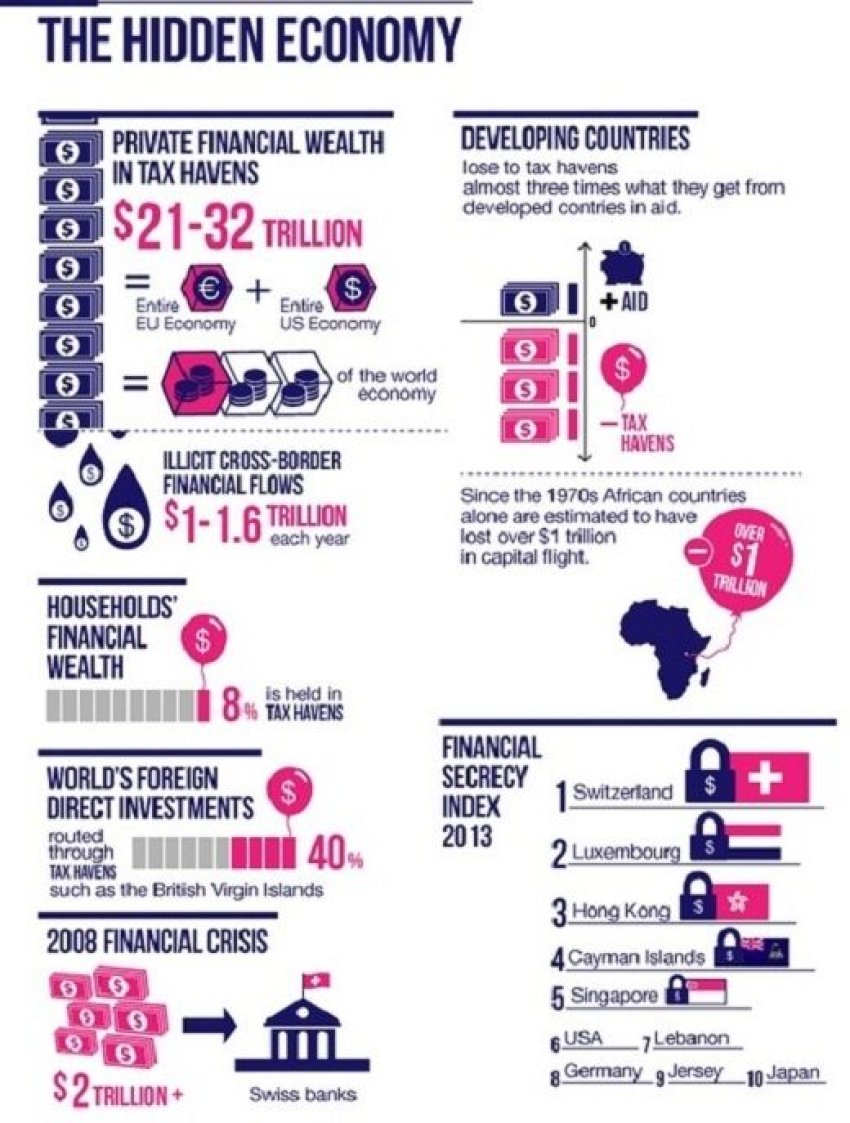

One of the most shocking revelations of the Panama Papers is that US protected multinationals and many of their allies around the world have US$32 trillion in tax havens.

The Panama Papers

- The Panama Papers are a massive and historic leak of confidential documents that reveal how the rich and powerful from many countries around the globe use tax havens to hide their wealth.

- About 140 high-level officials and millionaires, and about 113,000 shell companies are exposed in the documents, including at least 12 current or former heads of state, including Argentina's president, Mauricio Macri.

- The documents show how a law firm based in Panama City, Mossack Fonseca, helped clients throughout four decades launder huge amounts of money and avoid taxes, while evading any legal action against them.

- The leak involves about 11.5 million documents that would take one person 27 years to read.

- The three biggest tax havens around the world are: Hong Kong, British Virgin Islands and Panama.

infographic-tax_evasion11.jpg

Tax evasion infographic. TeleSUR English.

Tax Havens

- That in 1903, the administration of Theodore Roosevelt created the country after bullying Colombia to hand over what was then the province of Panama. Roosevelt acted at the behest of various banking groups, among them J. P. Morgan & Co., which was appointed as the country's official 'fiscal agent'.”

- That according to an in-depth research report published by the Financial Secrecy Index,“The history of Panama as a tax haven started ... when it began to register foreign ships to help Standard Oil escape U.S.-American taxes and regulations. Offshore finance followed in 1927, when Wall Street interests helped Panama introduce lax company incorporation laws, which let anyone start tax-free, anonymous corporations, with few questions asked.”

- According to various reports, including one by Tax Justice Network, the U.S. is one of the country's mainly responsible for tax evasion of huge corporations and multinationals, which along with U.S.-backed dictators and high-level politicians, have up to US$32 trillion hidden in tax havens.

- Many of the roots of the current global economic crisis can be traced back to offshore financial centers located in offshore tax havens.

[Reposted from .]