Boffins, bosses and the ACTU will discuss making the economy more “productive” in the upcoming Economic Reform Roundtable, but their main aim will be to find ways to protect the wealth of those who already have it. Graham Matthews reports.

Boffins, bosses and the ACTU will discuss making the economy more “productive” in the upcoming Economic Reform Roundtable, but their main aim will be to find ways to protect the wealth of those who already have it. Graham Matthews reports.

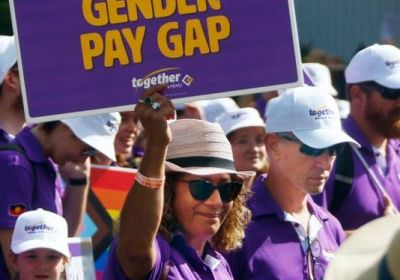

While the changes to superannuation have been welcomed by many, workers in the gig economy and women remain at risk of being left behind. Suzanne James reports.