-

Most of the first world is still feeling the effects of the global financial crisis (GFC), as economies remain either stagnant or in recession. The financial crisis can be traced back to the decision in the United States to lower interest rates, which fell from 6% in January 2001 to 1% in mid-2003. This led banks and other financial institutions, awash with cheap money, to conclude that lending to prospective home buyers at risk of being unable to afford their repayments was a safe bet. Between 2002 and 2007, sub-prime lending rose from 3% of US residential mortgages to 15%.

Most of the first world is still feeling the effects of the global financial crisis (GFC), as economies remain either stagnant or in recession. The financial crisis can be traced back to the decision in the United States to lower interest rates, which fell from 6% in January 2001 to 1% in mid-2003. This led banks and other financial institutions, awash with cheap money, to conclude that lending to prospective home buyers at risk of being unable to afford their repayments was a safe bet. Between 2002 and 2007, sub-prime lending rose from 3% of US residential mortgages to 15%. -

First there was climate denial. But the mocking laughter of the informed public – along with the indignation of the scientists – finally reached the energy-company boardrooms. So now instead we get the non sequitur. That’s Latin for “it doesn’t follow”. Rather than lying outright, the fossil-fuel chiefs make nakedly contradictory statements and count on us not to notice.

First there was climate denial. But the mocking laughter of the informed public – along with the indignation of the scientists – finally reached the energy-company boardrooms. So now instead we get the non sequitur. That’s Latin for “it doesn’t follow”. Rather than lying outright, the fossil-fuel chiefs make nakedly contradictory statements and count on us not to notice. -

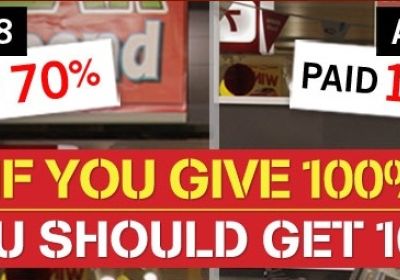

For the past eight months, I worked at a well-known retail chain for a fraction of the cost of other employees. I am 16-years-old and was being paid “youth wages”. I resigned at the end of February, even though I enjoyed working there.

-

When the CSIRO and the Bureau of Meteorology released their State Of The Climate 2014 report on March 4 it should have made headlines for days, provoked a big parliamentary discussion and a public debate about the emergency action we need to take to address the climate crisis.

-

These are dark times for would-be political satirists. We've now got a self-proclaimed “government of adults” headed by Tony Abbott and featuring the likes of Christopher Pyne and Cory Bernardi. These jokes are just impossible to top.

-

John Fenton is a farmer from Wyoming in the United States who has 24 gas wells on his property. He recently toured Australia to speak about the environmental and health impacts the gas industry has had on his land and community.

-

You can tell how good a newspaper is from the enemies it keeps. The Australian wrote a sneering dismissal of the new Saturday Paper, launched last weekend, and used its ultimate insult by comparing the new paper to Green Left Weekly, calling GLW “ignorant, moralistic and simplistic”.

-

Shares in Qantas were traded at $1.25 on February 21, the highest price since October last year. Anyone with more than a passing interest in the stock exchange would know that the company has been in deep trouble for some years. In October 2011, it stranded thousands of its passengers after it grounded its entire worldwide fleet during a union dispute. When rumours began circulating throughout the media after its half-yearly report meeting that Qantas was preparing to shed thousands of jobs at, its share price began to rise. Sacking workers is a profitable sign for speculators.

-

A report commissioned by the Victorian branch of the Electrical Trades Union (ETU) shows that energy sector privatisation in Australia has been "a dismal failure", which has produced "no benefits" for consumers, but has resulted in "large fiscal losses" for taxpayers.

-

The federal Coalition government is set on a path of unprecedented cuts to public services; Medicare is under threat, as are workers' penalty rates. Added to this is the large-scale selling out of action on climate change along with important natural environments, such as forests and the Great Barrier Reef, to make way for destructive mining and logging industries.

The federal Coalition government is set on a path of unprecedented cuts to public services; Medicare is under threat, as are workers' penalty rates. Added to this is the large-scale selling out of action on climate change along with important natural environments, such as forests and the Great Barrier Reef, to make way for destructive mining and logging industries. -

Institutionalised corruption in New South Wales stretches from the Rum Corps of the late 18th century to present-day politicians from the Labor and Liberal parties. The pattern has been consistent: public exposure, followed by the confected outrage of “shocked” politicians that comes with contrite promises of reforms. After a suitable time has elapsed, the cycle repeats.

-

“You don't want a wimp running border protection,” Prime Minister Tony Abbott said on February 21. “You want someone who is strong, who is decent, and Scott Morrison is both strong and decent.”