Nearly 10 years of a mining boom has made big changes to Australia’s economy and environment. Resource companies have made record profits.

This has given Australia’s rich mining billionaires an inflated sense of entitlement. When the Resources Super Profits Tax (RSPT) was proposed we saw Gina Rinehart speaking to an anti-tax rally from the back of a truck along with fellow billionaire Andrew Forrest, who wore a high-visibility work shirt as though he was just another struggling worker.

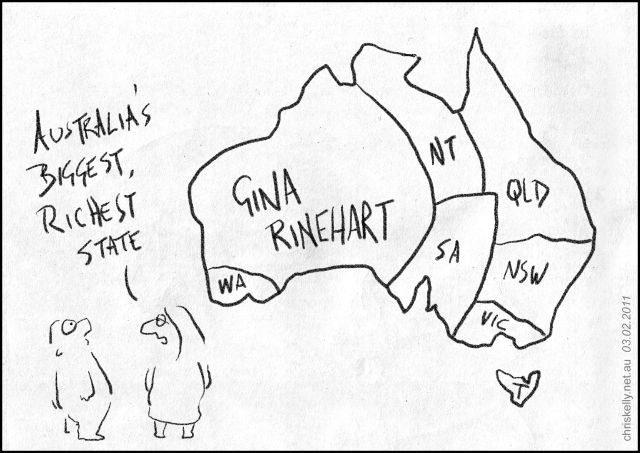

Having helped sink the RSPT (and its proponent Kevin Rudd), Rinehart went on to become the richest person in the country. But these prominent individuals are only the tip of the iceberg.

The big three players are BHP, Rio Tinto and Xstrata. Their combined value, internationally, is more than the size of Australia’s federal budget. They were not shy of throwing their weight behind the moves to sink the RSPT. Mining interests spent $22 million on its advertising campaign against the RSPT. BHP spent $4.2 million.

Yet the resources that make them so rich are not theirs. As farmers opposing coal seam gas companies have found out, they own only the topsoil. The resources below are “Commonwealth” property by law. Sadly, there is little to protect the “common wealth” of our farms or wilderness regions sitting on top when the resource below is handed to the mining companies.

The loud voices like Forrest and Rinehart were not afraid to say the RSPT was tantamount to nationalisation. But it was a fairly mild tax, in reality. More profoundly, the mineral wealth was always supposed to be the property of the whole country.

Progressive economists have begun to shine the spotlight on the economic, social, cultural and ecological cost of the resources boom. Protesting farmers and Aboriginal Australians are underlining the importance of the issue more publicly.

The mining, gas and oil industries need to be reined in. But are higher taxes the only solution? Consider if the industries were in public hands. No more would they be beholden to their shareholders, bound to maximise profits whatever the cost. Nor would their huge wealth be available for schemes to corrupt the political process.

We could rein in the overseas pillage that Australian miners instigate in poor countries such as Papua New Guinea and the Philippines. A publicly owned mining sector, not hungry to maximise profits at all costs, could make fair partnerships with poor countries to help them develop sustainably.

So much of what is now mined is not benign minerals, but uranium and dangerous fossil fuels. Australia is to coal as Saudi Arabia is to oil: the world’s biggest exporter. We should leave Australia’s coal, gas and uranium in the ground.

The wealth from the remaining important minerals like iron or rare earths could be spent on programs to combat climate change, to improve health care, or any number of other social programs.

But is public ownership realistic, if even the mild RSPT was knocked off?

Consider that privatisation remains unpopular despite more than 20 years of promotion by governments and academia. Trying to sell off NSW power generators has been a big stumbling block for both parties. The public still trust governments to run public utilities more than they trust private investors, despite the years of propaganda.

This stubborn public sentiment against allowing greedy, giant corporations to plunder the economy for their own benefit is matched by a widespread will to protect remaining wilderness areas, the climate and farmland.

“Nationalisation” is a dirty word in mainstream economics. It tends to be associated with radicals like Venezuelan president Hugo Chavez. But if we look around the world, you don’t have to go to anti-capitalists to find examples of strategic public ownership, even in the lucrative natural resources sector.

If privatisation is still unpopular, we need to move onto the front foot and make nationalisation a real option in the minds of ordinary people again.