Data reported in the last two months has shown Ukraine’s state finances to be under extreme stress, with the country almost certain to slip into hyperinflation if Russia's war continues beyond the next few months.

The Wall Street Millennial YouTube channel reported on September 18 that Ukrainian gross domestic product was expected to fall by as much as 50% this year. Five million people have now fled the country, and a further 7 million are internally displaced. Of the latter, few have been able to find new jobs, and the official unemployment rate has reached 35%.

A Deutsche Welle report entitled “Ukraine battles to avoid hyperinflation as war costs soar” released on August 27 noted that tax revenues had collapsed to about one fifth of their pre-war level, and were covering only about a third of the government’s expenditures. To make up this shortfall, the Kyiv authorities have been seeking foreign loans and grants, and attempting to borrow on the local market.

However, the loans and grants are proving nowhere near enough to plug Kyiv’s budgetary gaps. The collective West, the Wall Street Millennial site notes, “has committed about [US]$30 billion of funding for 2022”, that is, approaching US$3 billion a month. But the Ukrainian state budget deficit is running at about US$9 billion a month.

In these circumstances, the Kyiv government’s only choice has been to sell state bonds to the National Bank — in effect, to print money. In June alone, Deutsche Welle quotes the Financial Times as saying, the printing presses created the equivalent of US$3.6 billion. Backed by nothing but thin air, this mass of extra buying power is certain to fuel high levels of inflation.

In the international field, Kyiv’s prospects are similarly dire. Sellers in world markets have little interest in supplying goods in return for hryvnias, the Ukrainian currency, and Ukraine’s ability to earn dollars and euros from exports has largely collapsed. According to Wall Street Millennial, food exports are now at only about half of prewar levels.

To continue buying essential inputs from abroad, Ukraine is having to deplete its reserves of foreign exchange. As of September, about US$6 billion of an earlier US$31 billion had been drawn down. To slow the attrition, strict currency controls have been imposed. At present, there is a ban on transferring foreign currency abroad to repay and service debts owed by Ukrainian businesses to non-residents.

While this may aid in keeping the country technically solvent, its effect on the willingness of foreign firms to conduct business with Ukrainian companies can be imagined.

In August, the Ukrainian government persuaded its major creditors to accept a two-year freeze on servicing the country’s foreign debts. But the freeze has a serious downside: raising money by selling Ukrainian government bonds abroad has become close to impossible.

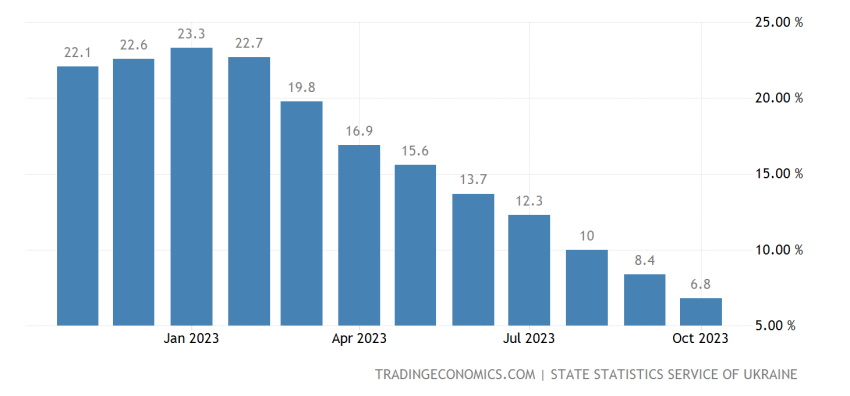

Not surprisingly, inflation in Ukraine has mounted steadily during the war, from an annual rate of 7–8% at the beginning of the year to 23.8% in August. In July, the rising prices forced a 25% devaluation of the hryvnia, which had been pegged to the US dollar following the Russian invasion in February. By keeping dollars cheap, the peg had strengthened the national currency and restrained inflation; now, this restraint was substantially loosened.

Inflationary pressures on the hryvnia are certain to mount much further in coming months. To a large extent, this will result from the combination of a booming money supply with production constraints, as Russian attacks on infrastructure, especially the electricity and transport systems, reduce output in the economy. But as the northern winter approaches, another factor will kick in: the need to secure gas supplies for industry and domestic heating.

In recent years, Ukraine has needed to import close to half of its natural gas consumption. Early in September, European gas prices were up by almost 400% from their level a year ago. For Ukraine to import sufficient gas for the winter at current prices, the Wall Street Millennial site calculates, would cost about $7 billion. This would require a devaluation far greater than the 25% seen in July. On the basis of experience during the economic crisis that followed the Maidan revolt in 2014, the site suggests, the figure would need to be as much as 70%.

The implications of this are horrifying. As the site continues, “[it] means they will have to print three times as much money to achieve the same purchasing power”. In these circumstances, a slide into hyperinflation would be “all but guaranteed”.

Hyperinflation is commonly understood as inflation of more than 50% a month or 1000% a year. In these circumstances, the national currency essentially dissolves as a store of value, and the buying power of anyone on a fixed wage collapses. Anyone who holds the local money does their utmost to turn it into material goods or foreign banknotes as quickly as possible. Store shelves are quickly stripped, with merchandise finishing up piled in the dwellings of people who would normally have little need of it; meanwhile, people who genuinely need the goods must often go without.

For many purposes barter, with all its inefficiencies, replaces money. For employees of the enterprises that remain open, turning up for work can make little sense; the returns tend to be far better if the time is spent hustling on the street. The economy becomes “dollarised”, and concluding any substantial deal requires wads of foreign cash.

For a country in this condition to prevail in a war is almost unimaginable. So will Ukraine's sponsors and allies bail it out? At a time when profits in key Western economies have slumped, payouts of promised financial assistance to Ukraine are already proving slow to arrive. Donors are quibbling over whether the aid should be in the form of grants or interest-bearing loans.

The chances that NATO governments will now assign extra billions of dollars per month as aid to Ukraine seem vanishingly small.