Whoops! Why Everyone Owes Everyone & No One Can Pay

By John Lanchester

224 pages

Penguin, Allen Lane

Review by Mat Ward

If you don't know the difference between a credit default swap (CDS), a collateralised debt obligation (CDO) and a cheese sandwich, this highly readable book could help you in a painless, entertaining way.

Its author, John Lanchester, grew up in 1960s Hong Kong. He says the contrasts of obscene wealth and crushing poverty were “like a lab test in free-market capitalism”.

Global Financial Crisis (2007–2008 financial crisis, GFC)

After a month of thundering that a rise in the official interest rate was close, the Reserve Bank of Australia (RBA) has kept interest rates on hold at its monthly board meeting on October 5.

Most financial commentators were betting on a rate rise of 0.25%, with banks expected to increase their mortgage rates by an even larger margin, despite their record profits, to account for higher costs of borrowing overseas. However, the dark financial clouds over Europe and the US appear to have put the kibosh on the financiers’ party.

More than 10 million workers staged a general strike in Spain on September 29 in response to vicious government attacks on their rights and pensions.

The huge mobilisation, organised by the Confederacion Sindical de Comisiones Obreras (CCOO) and Sindicato Union General de Trabajadores (UGT) labour unions, produced a 75% turnout of members, sending a strong message of opposition to the austerity measures.

UGT secretary for organisation and communication Jose Javier Cubillo said that in some sectors of the economy, such as steel and energy, support for the strike was close to 100%.

More than three million people took part in strikes and protests across France on September 23. They were demanding the withdrawal of laws that will dramatically reduce the right of workers to access pensions. The protests, which had been called by a coalition of seven of France’s union confederations, showed that the passage of the Pension Bill through France’s lower house of parliament had done nothing to weaken opposition to the attack on pensions.

Edward Bernays, the US nephew of Sigmund Freud, is said to have invented modern propaganda. During the World War I, he was one of a group of influential liberals who mounted a secret government campaign to persuade reluctant Americans to send an army to the bloodbath in Europe.

In his 1928 book Propaganda, Bernays said the “intelligent manipulation of the organised habits and opinions of the masses was an important element in democratic society” and that the manipulators “constitute an invisible government which is the true ruling power in our country“.

The global carbon market, which trades “pollution rights” to encourage industry to cut greenhouse gas emissions, grew in 2009. Far from signaling a success, this reflects a huge increase in fraud, the dumping of surplus emissions permits by industry, and a rise in financial speculation.

The financial reform legislation just passed by Congress was proclaimed by US President Barack Obama as “the toughest financial reform since the ones we created in the aftermath of the Great Depression”.

This is a kind of doublespeak. The entire thrust of financial reform in the decades since the 1930s has been toward financial deregulation. Being the toughest financial reform measure by that standard merely means that it didn’t give the house away.

A huge police crackdown on protesters at the June 26-27 G20 Summit in Toronto last week ended in the arrests of hundreds of primarily peaceful activists. Canadian group Socialist Project issued this statement on June 30 in solidarity with the protesters targeted by police. It is reprinted from The Bullet.

* * *

The massive police presence in Toronto over this week has been officially justified on the basis of protecting the leaders of the G8 and G20 countries meeting in Huntsville and Toronto.

Two million Spanish workers participated in a public sector strike on June 8. A general strike in the Basque country has been called for June 29. Spanish unions have called a nationwide general strike for September 29 and the European Trade Union Confederation is currently attempting to organise a Europe-wide general strike to coincide with it.

Thousands of workers across France protested on May 27 against President Nicholas Sarkozy’s planned attacked on the French pension system.

The protests were called by a coalition of union confederations, including the General Confederation of Labour (CGT); French Democratic Confederation of Labour (CFDT); United Union Federation (FSU); National Union of Autonomous Unions and Solidaires. They came after the government failed to withdraw or modify the planned changes to the pension system following protests on March 23 and May 1.

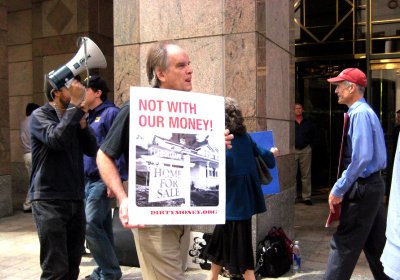

Resistance is building in Europe against government attempts to force ordinary people to bailout the failed financial system of “casino” capitalism.

After four general strikes in Greece this year, and two more planned, strike action is beginning in Spain against planned attacks on public services and welfare.

This Time is Different: Eight Centuries of Financial Folly

By Carmen Reinhart & KennethRogoff

Rrinceton University Press, 2009, 496 pages

Review by Barry Healy

Australia has had a lucky escape from the Global Financial Crisis (GFC) our noble leaders and economic pundits tell us.

Not so, says 800 years of economic experience assembled in This Time Is Different: Eight Centuries of Financial Folly.

- Previous page

- Page 3

- Next page