Labor seems more determined than ever to promise little, hoping the next election will land in its lap without offering any meaningful change, argues Jon Strauss.

corporate tax cuts

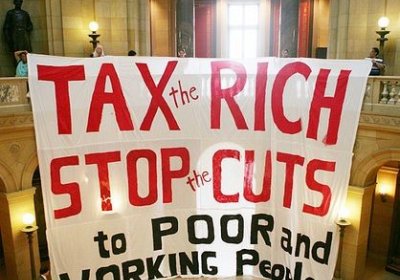

The federal Coalition government's so-called "tax reform" package is, overall, a major escalation of the capitalist class war by the rich against the poor and working people.

The initial tranche of income tax measures will reduce tax by a very modest amount for low-income taxpayers, but the long-term effect of the package is to massively reduce tax on the wealthy and attack the elements of a progressive taxation system established in this country over many years.

Labor Opposition leader Bill Shorten delivered his budget reply speech on May 10, promising to deliver a “bigger, better and fairer tax cut for 10 million working Australians”.

Yet again, the federal Coalition government has launched a broadside in favour of its plan to cut company tax for big corporations from 30% to 25%, while slashing spending on social welfare and the public sector.

The catalyst for the latest controversy on the issue was a February 14 article on the ABC website by chief economics correspondent Emma Alberici, entitled, “There's no case for a corporate tax cut when one in five of Australia's top companies don't pay it.”

If the federal government is convinced its proposed corporate tax cuts will bring happiness all around, why is it so worried about those challenging the idea?