The World Economic Forum (WEF) Africa summit in Kigali, Rwanda, on May 11 to 13 reinforced extractive industry and high-tech myths.

The gathering unveiled the elite's exuberant imagination and its lack of exposure to the continent's harsh economic realities. As an antidote, grassroots protesters all over Africa are questioning the logic of export-led “growth” and renewed fiscal austerity. Instead they demand policies that meet their basic needs.

Surreal self-congratulatory rhetoric is on the lips of many WEF luminaries, epitomised by ethically-challenged former British Prime Minister Tony Blair celebrating the dictatorship of Rwandan host Paul Kagame.

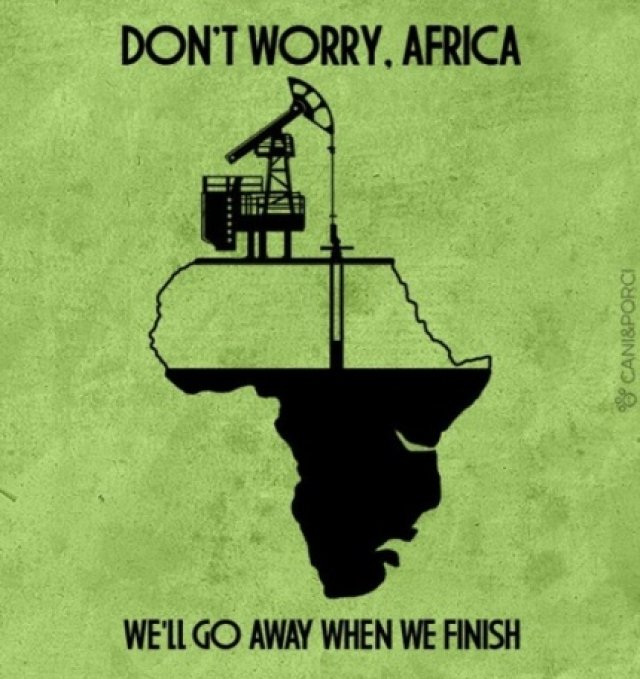

“Africa will probably remain natural resources-driven for the next two decades at least,” pronounced software executive and WEF leader Brett Parker.

In reality, commodity prices have crashed to record lows since 2011, leaving resource-dependent societies like Nigeria in profound crisis.

Oil prices fell below US$30 a barrel earlier this year and hover around $48 today — from a 2008 peak of $140. Yet Standard Chartered Bank's Razia Khan argues that Uganda should keep pumping scarce investment funds into petroleum exploration, notwithstanding production costs there of $70 a barrel.

Ignoring the data, African Leadership University's Fred Swaneker intoned: “The Africa Rising narrative presents the most compelling argument for the continent's prosperity.”

Fanciful claims

New elements of “Africa Rising” hucksterism emerged at this year's WEF. These included a child-like fascination with “Fourth Industrial Revolution cyber-physical systems” — artificial intelligence and the like — that will supposedly allow Africa to leapfrog the world. It will even “lead the way”, because the continent is “the world's fastest growing digital consumer market.”

Reality check: fewer than one in three Africans have home electricity, and just one in five have used the internet.

Still, vain hopes for vibrant consumption markets continue. When Cape Town hosted the WEF in 2011, African Development Bank (AfDB) economist Mthuli Ncube made fanciful claims about the new middle class: “Hey you know what, the world please wake up, this is a phenomenon in Africa that we've not spent a lot of time thinking about.”

Even the Wall Street Journal, one of the world's great business periodicals, was fooled by Ncube: “Last year, the continent's 313 million-person middle class — those who spend between $2 and $20 a day — comprised about 34% of the population.

“Its number rivals that of the middle classes in China and India, according to the study, which was reviewed by the Wall Street Journal.”

That review was rather incomplete. Massively indebted and unable to buy even basic foodstuffs for $2 a day in most African cities, the supposed mass middle class has fizzled.

A more accurate rendition of “middle class” lifestyles would start at $20 a day. This group of Africans actually fell as a share of the continent's population from 6.5% in 2000 to just 4.8% even at the peak of the commodity boom in 2010, as even Ncube's data show.

A Reuters journalist recently admitted: “Whether it's selling pensions, pasta or toothpicks, investors in Africa have been targeting the booming middle class. But a year of diving commodity prices has exposed how much the continent, and its consumers, still rely on exporting resources.”

As reality dawns, even the continent's oldest retail bank, Barclays, has just announced it will sell its African operations.

Climate change

The most gloomy reason to fear for Africa's future — climate change — was distorted beyond recognition at Kigali. Referring to the December United Nations climate summit in Paris, director of the Africa Progress Panel Caroline Kende-Robb said: “COP 21 in Paris was an unambiguous success [because] African nations seized the chance to shift the climate narrative from one of dependence to one of opportunity and transformation.”

In reality, African activists criticised Paris because:

• emissions cut commitments are non-binding and inadequate (even if promised cuts are realised, the temperature will rocket up 3ºC, killing hundreds of millions of Africans);

• US negotiators reintroduced the failed strategy of carbon trading (the 'privatisation of the air'); and

• the deal officially prohibits “climate debt” lawsuits against Northern over-emitters who bear liability for climate damage.

The African elites who signed the Paris deal — denounced by leading climate scientist James Hanson as “fraud” and “bullshit” — condemned their citizens to a hellish future of climate apartheid.

The WEF fibbery and desperate corporate huckstering seem more frenetic than in past years. Perhaps this is because, lurking behind the elite backslapping, there is widespread African social resistance to neoliberal power and ideology.

Across Africa, the establishment's public policies still fail to deliver and much of the continent's wealth has been looted.

Yet just as the International Monetary Fund (IMF) recognises that unrepayable debt has again mounted, requiring “fiscal consolidation” (spending cuts), African protesters have gathered five years of momentum to resist.

Afro-optimism

Indeed, if we consider various measures of civil society activism against perceived injustices, “Afro-optimism” should be back in style — seen from the grassroots perspective.

Since 2011, the continent has witnessed a dramatic spike in social protests, as recorded by the African Development Bank (AfDB) based on Agence France Press and Reuters reporting. According to the AfDB's 2015 African Economic Outlook, from 2011 to 14 protests occurred at a rate at least five times greater than in 2000.

Rather than falling back after the dramatic “Arab Spring” — the 2011 North African uprising that was especially intense in Tunisia, Egypt, Libya and Morocco — the continent's protesters subsequently picked up the pace in Algeria, Angola, Chad, Gabon, Kenya, South Africa, Uganda and many other countries.

Press reports confirm that the vast majority of protests since 2011 were over inadequate wages and working conditions, the low quality of public service delivery, social divides, state repression and lack of political reform.

Some social turmoil is localised, taking place in the vicinity of mines and oil wealth. South Africa is witnessing many mining struggles, such as the battles against titanium, iron ore and coal within a couple of hours drive of Durban.

Labour is also frequently revolting in Africa. The WEF's Global Competitiveness Report authors asked businesses how to “characterise labour-employer relations” in terms of cooperation versus confrontation. African countries typically account for 40% of the “most militant” countries, far higher than any other region.

Since 2012, the South African working class has been ranked angriest, earning the gold medal in the global class struggle.

Causes of these revolts include the continent's worsening fiscal shortages. In South Africa, legal flows of profit, dividends and interest out of the country has driven the past 15 years of current account deficits, in turn requiring South Africa to borrow abroad to make up the difference: the country's foreign debt has soared from $32 billion in 2000 to $140 billion today.

The Sub-Saharan African debt has doubled to more than $400 billion in the last decade, and when debt default nears, as will soon be common, the neoliberal IMF returns to the scene with disastrous effect, just as in the 1980s and '90s.

The African “voice” at the IMF is getting quieter, especially after the December board restructuring due to new shareholder weights favouring China (+37%), Brazil (+23%), India (+11%) and Russia (+8%).

But contrary to rhetoric about BRICS solidarity, Nigeria lost 41% of its voting power followed by Libya (-39%), Morocco (-27%), Gabon (-26%), Algeria (-26%), Namibia (-26%) and even South Africa (-21%).

Last month, the IMF's Regional Economic Outlook for Africa suggested that “a substantial policy reset is critical in many cases”.

Offering no new economic policy advice to lower vulnerability to commodities and debt, the IMF predictably intoned: “Because the reduction in revenue from the extractive sector is expected to persist, many affected countries also critically need to contain fiscal deficits and build a sustainable tax base from the rest of the economy.”

It is hard to translate this as anything other than the standard command to lower social spending and impose higher taxes on ordinary people.

Precisely this combination — a policy “reset” that is actually more of the same neoliberalism — is the underlying material conditions causing what US academics Adam Branch and Zachariah Mampilly term the “Africa Uprising”.

Unrealised potential

The enormous potential for the protests they document has not yet been realised, because in so many sites of struggle, state repression rises. The protests, Branch and Mampilly conclude, then “fragment into particularised constituencies without a common vision for progressive political change in the country”.

Nearly six decades ago, Frantz Fanon warned in his book For the African Revolution: “For my part, the more I know political cultures and circles, the more the certainty is imposed on me that the greatest danger to threaten Africa is the lack of ideology.”

However in at least one vital protest zone, South Africa, a May Day gathering of more than 50 trade unions — led by the continent's most militant, the 350,000-strong National Union of Metalworkers of South Africa — announced that a new workers federation will soon emerge bearing a socialist ideology.

Hopefully it will, in turn, revive the loose united front alliance of several hundred social movements and left organisations. A workers' party is promised by these forces, perhaps to merge with the Marxist-Leninist-Fanonist Economic Freedom Fighters prior to the next national elections in 2019.

But even if the protest upsurge is ignored (or repressed) in Kigali and within the WEF set, more awareness about popular risings against 'Africa Rising' rhetoric is long overdue, given the former's potential and latter's utter bankruptcy.

[Abridged from Links International Journal of Socialist Renewal. Patrick Bond is professor of political economy at the University of the Witwatersrand.]

Like the article? Subscribe to Green Left now! You can also like us on Facebook and follow us on Twitter.