The cost of bailing out corporate Australia during the COVID-19 pandemic is still rising. The federal government has announced measures costing about $200 billion so far, and state governments have provided supplementary payments to businesses and landlords.

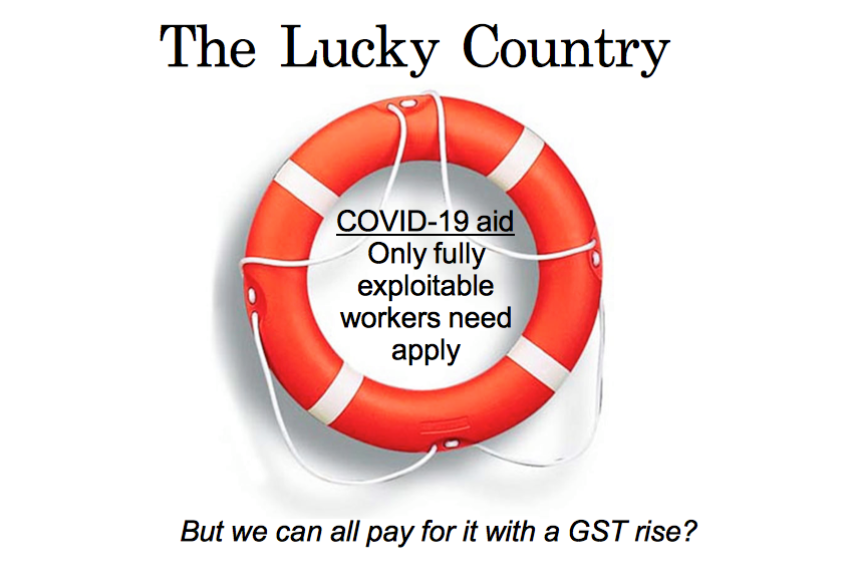

These measures are being sold to the public as helping ordinary people. But millions of desperate people are missing out. This is because, fundamentally, the bailouts are designed to protect the capitalist economy.

The bill for the coronavirus bailout already exceeds the global financial crisis bailout, and it is still going up. Virgin Australia has just put its hand out for $1.4 billion.

So who will be made to pay when things “go back to normal”?

It might be many months before there is any possibility of things going back to how they were — and some things like international travel may never return to what it was — but the debate about who will shoulder the cost of the bailout is beginning.

The Guardian Australia reported on April 14 that Professor Robert Breunig, who heads up the Australian National University’s tax and transfer policy institute, wants the government to raise the Goods and Services Tax (GST) to pay the debt, because the alternative would have to rely on company tax and income tax.

Breunig’s argument against the latter course is that this would inhibit economic growth. He supports increasing the rate of GST and reducing the goods and services that are currently exempted.

The GST is a regressive tax that disproportionately hurts the poorest households. A study commissioned by the Australian Council for Social Service showed that raising the GST rate from 10% to 15% and expanding the range of goods and services subject to a GST could reduce the incomes of the poorest 20% of households by 4.6%, compared to 1.7% for the richest 20%.

If that sounds like a familiar refrain, it is.

Every Coalition Prime Minister from John Howard to Scott Morrison insists that if we cut taxes on companies and the rich we will grow a bigger pie so we can all have a bigger slice.

The reality however is that this line has made the super rich even richer and left wages flat or falling, and ordinary households saddled with more debt than ever before.

Green Left has consistently opposed tax cuts for the rich that both Labor and Coalition governments have introduced. We campaigned against the Coalition’s July 2019 tax cuts while the Labor opposition shamefully voted for them.

We’ve called for an end to the billions of dollars in subsidies for the fossil fuel companies and the robbery-in-plain-sight by multinational corporations exploiting tax havens and outrageous tax avoidance schemes.

The question of who will be made to pay for this latest government bailout of capitalism will ultimately depend on the balance of forces between the billionaire class and the rest of us.

The bankruptcy of 21st century capitalism is more exposed than ever before with the climate emergency and, now, the utter failure of the richest capitalist state in the world, the United States, to save lives.

The more people who can be won over to the cause of system change during this COVID-19 crisis, the better position the majority will be in to democratically decide who pays.

If you agree with our perspective, then become a Green Left supporter or make a donation to our Fighting Fund.